Understanding Insurance Valuation: The Foundation of Your Claim

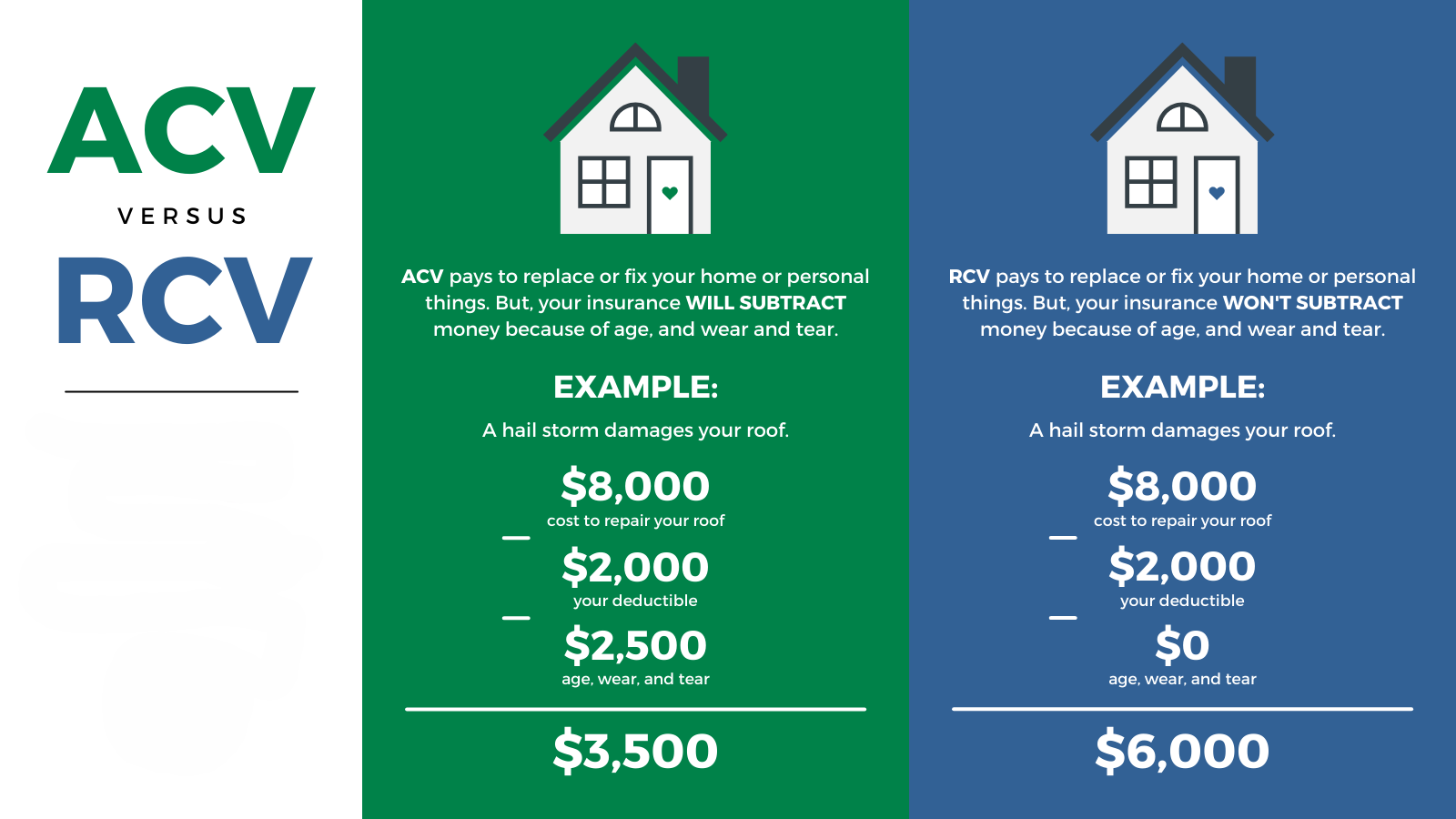

When filing an insurance claim for property damage, you'll encounter several critical terms that directly impact your settlement amount. Understanding depreciation, Replacement Cost Value (RCV), and Actual Cash Value (ACV) is essential for every policyholder navigating the claims process.

These valuation methods determine how much your insurance company will pay for damaged or destroyed property, making them crucial factors in your claim's outcome. Let's break down each concept and explore how they affect your settlement.

What is Replacement Cost Value (RCV)?

Replacement Cost Value (RCV) represents the amount needed to replace or repair your damaged property with materials of like kind and quality at current market prices, without deducting for depreciation. This valuation method provides the highest potential payout for policyholders.

For example, if your 10-year-old roof sustains storm damage, the RCV would be the full cost to install a brand-new roof of similar quality today, regardless of the original roof's age or condition.

Key Benefits of RCV Coverage:

- Full replacement cost without depreciation deductions

- Protection against inflation and rising material costs

- Ability to restore property to pre-loss condition

- Maximum claim settlement potential

Understanding Actual Cash Value (ACV)

Actual Cash Value (ACV) equals the replacement cost minus depreciation. This method considers the age, wear, and condition of your property at the time of loss, resulting in lower claim payouts compared to RCV coverage.

Using our roof example, if the replacement cost is $15,000 but the roof has depreciated by $6,000 due to age and wear, your ACV settlement would be $9,000.

How ACV Affects Your Claim:

- Lower settlement amounts due to depreciation deductions

- May not cover full replacement costs

- Requires out-of-pocket expenses for upgrades

- Common in older policies or basic coverage plans

The Role of Depreciation in Insurance Claims

Depreciation is the reduction in value due to age, wear, obsolescence, or other factors. Insurance companies use various depreciation methods to calculate how much value your property has lost over time.

Common Depreciation Factors Include:

- Age of the property or materials

- Normal wear and tear

- Maintenance history

- Market conditions and technology changes

- Expected useful life of materials

Understanding how your insurer calculates depreciation is crucial, as these calculations directly impact your claim settlement. Different insurance companies may use varying depreciation schedules, potentially affecting your payout significantly.

How RCV and ACV Impact Your Insurance Claim Settlement

The type of coverage you have fundamentally changes your claim experience and final settlement amount. Here's how each approach affects your claim:

With RCV Coverage:

Your insurance company typically pays the ACV amount initially, then releases the depreciation (recoverable depreciation) once you complete repairs or replacement. This two-step process ensures you receive the full replacement cost while preventing claim fraud.

With ACV Coverage:

You receive only the depreciated value, which may not cover the full cost of repairs or replacement. This often leaves policyholders responsible for significant out-of-pocket expenses.

Maximizing Your Claim: Professional Strategies

To ensure you receive fair compensation, consider these important strategies:

Document Everything Thoroughly

Maintain detailed records of your property's condition, age, and maintenance history. This documentation helps justify higher valuations and challenges unfair depreciation calculations.

Understand Your Policy Terms

Review your insurance policy to understand whether you have RCV or ACV coverage. Some policies offer RCV for the dwelling but ACV for personal property or other structures.

Challenge Unfair Depreciation

Insurance companies sometimes apply excessive depreciation. A qualified public adjuster can review these calculations and advocate for fair treatment based on actual property conditions and market values.

Complete Repairs Promptly (RCV Policies)

With RCV coverage, you must typically complete repairs within a specified timeframe to recover depreciation amounts. Failing to do so may result in forfeiting these funds.

When to Seek Professional Help

Navigating insurance valuations and depreciation calculations can be complex and overwhelming. Consider professional assistance when:

- Your claim involves significant property damage

- You disagree with the insurance company's depreciation calculations

- The settlement offer seems insufficient for proper repairs

- You're unfamiliar with your policy's specific terms and conditions

- The insurance company denies or undervalues your claim

Why Choose Professional Public Adjusting Services?

Public adjusters understand the intricacies of insurance policies, depreciation schedules, and claim valuation methods. They work exclusively for policyholders, not insurance companies, ensuring your interests remain the top priority throughout the claims process.

Professional adjusters can help you understand complex policy language, properly document damages, challenge unfair depreciation calculations, and negotiate with insurance companies to maximize your settlement.

Get Expert Help with Your Insurance Claim Today

Don't let confusing insurance terminology or unfair depreciation calculations reduce your rightful settlement. Understanding RCV, ACV, and depreciation is just the beginning – having an experienced advocate on your side makes all the difference.

Contact Apex Adjusting Group today for a free consultation. Our experienced public adjusters will review your policy, evaluate your claim, and fight for the maximum settlement you deserve. We work on a contingency basis, so you pay nothing unless we successfully increase your claim settlement.

Call us now to protect your interests and ensure you receive fair compensation for your property damage claim.

Need Help with Your Insurance Claim?

Our licensed public adjusters can help you get the maximum settlement you deserve. Contact us today for a free claim evaluation.